Scammers like to hide under masks or wear disguises — like dressing up as your bank — to scare you into giving them secure personal or financial information.

This spooky season, we want to help you refresh your cybersecurity knowledge so you know how to tell a trick from a treat.

You can test your knowledge by taking our spooky scam-spotting quiz, or keep reading to learn how to spot a scam!

What are scare tactics, and how do scammers use them?

Scare tactics are threats and high-pressure language that scammers use to intimidate you into giving them secure personal or financial information.

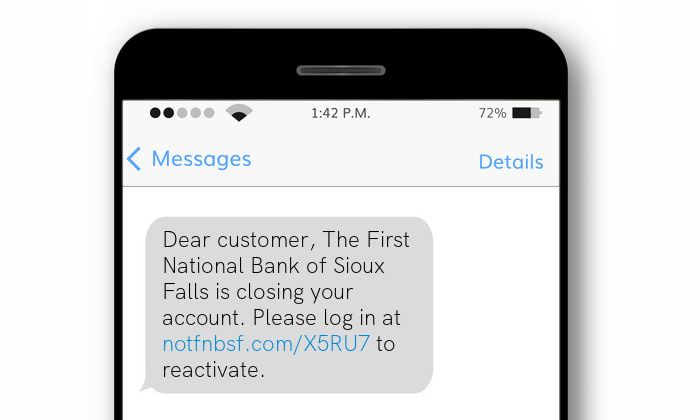

This could include language like, “We’ve closed your account,” or, “You’re being charged a $100 fee for account inactivity.”

Their goal is to scare you into clicking on a link, downloading an attachment, calling a fake phone number, or taking some other detrimental action.

Alternatively, scammers might give you an ultimatum: “Do [this] or [this bad thing] will happen.”

Scare tactics are extremely effective for scammers posing as your bank since their main goal is to get you to take some action without first thinking through the details of the situation.

How can I spot a scammer?

We would never ask you to verify account information or confirm a password online, and we certainly would never try to threaten or scare you into giving us secure information.

When there’s a problem with your account, we would only ever try to help you — which is why scare tactics are an easy way to identify a scammer.

If you receive a text, email, phone call, or some other communication from someone claiming to be us, simply take a deep breath and think it through.

Consider the circumstances of the communication. If the answer to any of the following questions is “yes,” then it’s likely a scam:

- Did I receive the communication from an unfamiliar email address, phone number, or caller?

- Are there typos, misspelled words, or glaring grammar mistakes?

- Is generic language like “Dear customer” being used instead of my name?

- Is secure personal or financial information being requested?

- Are scare tactics being used to intimidate me into taking a specific action?

You can ask yourself these questions while taking our scam-spotting quiz to test it out!

What should I do if I think I’m being scammed?

If you ever receive a communication that seems suspicious, just call us directly at (605) 335-5200.

We will be able to confirm whether or not the communication came from us, and we can help remedy the situation if you think you may have given away sensitive information or your account has been compromised.

Note, though, that we will ask you to verify your account challenge questions — this is just an extra layer of security we use to make sure it’s really you.

What can I do to protect myself from a scam?

First, if you think that you don’t currently have challenge questions set up for your account, give us a call so we can help you add them.

These challenge questions will help protect your account if a scammer does happen to get access to your username and password.

Then, read our blog on securing your financial information to learn how to protect yourself from future scams!