It all started with cutting up curtains.

It’s a true story, but it also contains a metaphor that any entrepreneur could relate to.

“At one point, I ran out of money for supplies,” said Rebekah Scott regarding the origins of her handmade purse and accessories business, Rebekah Scott Designs. “I was pacing around my living room like, ‘What am I going to do? I can’t take anything to the show.’”

“My curtains were super cute,” she continued. “So, I crawled up on a stool and cut my curtains down and put those into purses.”

It was an act of sacrifice, representative of the drive it takes to start and run a successful business.

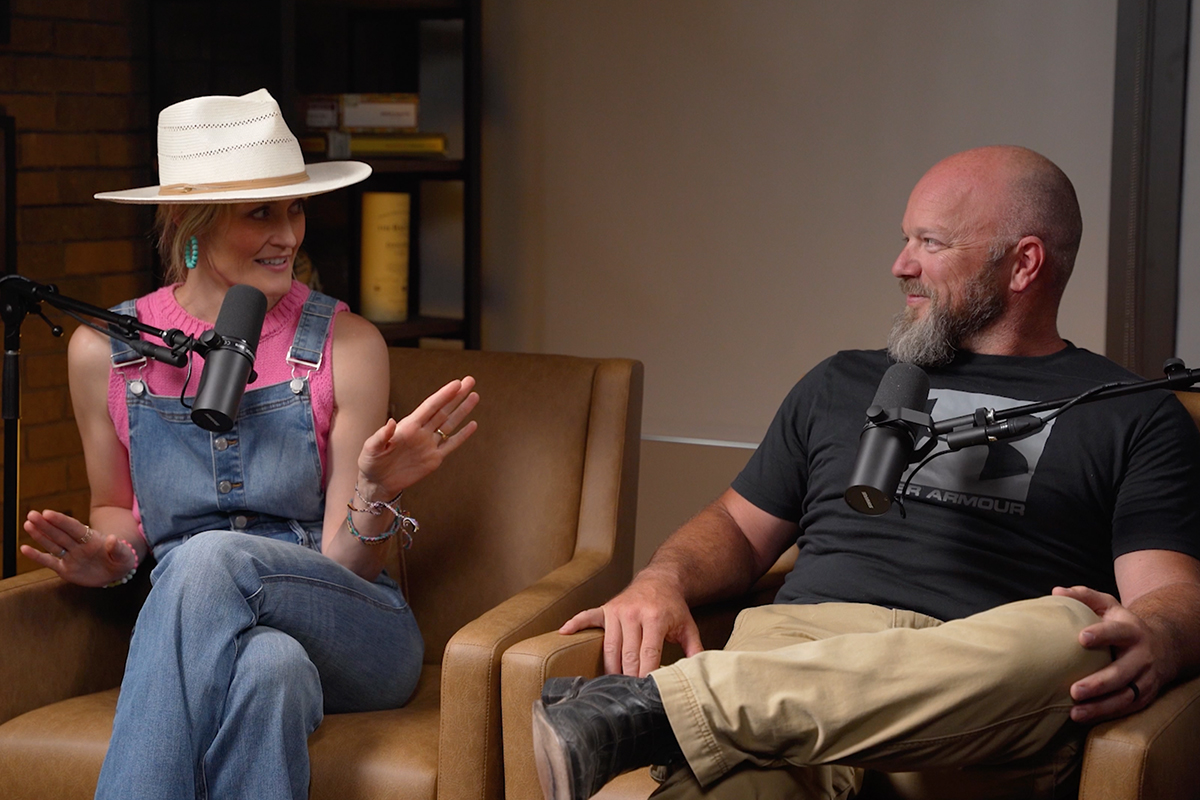

More than 15 years later, Rebekah is sharing her story on the latest episode of our podcast, Common Cents on the Prairie™.

She and her husband, Nick Scott — a fifth-generation farmer and rancher near Brandon, SD — joined me to chat about their entrepreneurial journeys and how they manage money as a couple.

We’ve rounded up three key takeaways from the episode. You can read more about those below, and, when you’re ready, you can watch the full episode on YouTube.

1. Dave Ramsey saved their marriage

Adam: You two met when you were around 14 years old. Tell me about the early days of your relationship when it comes to money. Have you always been on the same page, or did you have some work to do?

Rebekah: Oh, we had work to do. Fast forward a little bit to when we first got married: I was working in radio, and one of the gals was teaching the Dave Ramsey course.

She knew that we had just gotten married, and she was like, “This will change your marriage. You’re the perfect example of who needs to take it.”

So we took it on Thursday nights for 13 weeks, and it drastically changed everything moving forward. We had to do kind of a hybrid version because we do farm and ranch, but that got us on the same page so early on.

Nick: We didn’t have that much in the beginning, and I think it’s easier to not worry about money when you do have a lot. When it was tight, that was when we were butting heads or I was not on the same page as her.

It was beginning to be a fight. So Dave Ramsey, I would say, saved our marriage. Or, at least, it made it a lot easier.

Rebekah: For sure. After that, then we didn’t fight about money. We’d just talk about it. We still talk about it. We don’t end up fighting about it ever because there’s an overarching end goal.

2. Turkey tastes different in a family business

Adam: Nick, let’s talk about farming. You were the fifth generation to farm on the ground that you’re farming on today. Did you always know you wanted to carry on that legacy?

Nick: Did I always know that I wanted to farm? Yes. Did I always know that I was going to carry on the legacy? No. I think that’s two separate questions.

Adam: Farming, a lot of times, can be a family business. And family businesses can bring different dynamics to the table. So, how have you navigated those dynamics?

Nick: Working with my dad and uncle, I was a hired hand. I had to know my place or my role, so to say. And as it got further down the years of being in that position, I started realizing I needed to maybe step up and be a louder opinion or voice.

And, that’s probably when three minds don’t always see eye to eye. Sometimes it’s the two that see it one way and the third wheel, you know? After years of being that full-time hired hand, we decided that it was probably best to part ways with my uncle.

I talked to my dad and said, “You know, we’re either going to do this or I’m going to leave and go back to construction.” Because even though it is a family farm — there’s so many family farms out there — the problem that they get into, or we get into, is we treat it as a family and not as a business.

That’s where I started seeing it as not a very good business. Moving forward, it’s also been hard because it’s like, “Okay, Dad, do you want me to treat you as my father right now? Do you want me to treat you as a partner?”

Because right now I can respect you as my father, but you also need to respect me as your partner. And I think that will continue from now until the end of time. You know, how do you balance Thanksgiving dinners?

Rebekah: Turkey tastes different.

3. Business success comes from hard work, sacrifice…and curtains

Adam: Rebekah, you are a founder, and you’ve been running your business for 15 years. Is that right?

Rebekah: It’s a little fuzzy right now, because I looked at my sales tax license and I opened Rebekah Scott Designs in 2004. Clearly, I’m not old enough to run a business for 20 years! But, yes, it’s been 15-plus years now.

Adam: Tell me about the origins of the business. How’d you get started?

Rebekah: I’ve always sewn. I’m a good 4-Her, and I watched my mom be super joyful when she was sewing. So, I liked sewing just because I got to see my mom like it.

We were poor newlyweds and didn’t know what we’d do for Christmas gifts, but I’m a big giver. I wanted to give something. And I love purses; I think it’s the easiest thing to update an outfit. It’s like a home away from home. I’ll say no more, because I could always go on about purses.

Adam: Hey, I am a husband and a father of two girls. I get it.

Rebekah: So, I sewed Christmas gifts. I had my sewing machine that was my college graduation gift. Some people get cars — I get a sewing machine. I had fabric, so I sewed some purses. And then I started getting orders from their friends and family. Like, “Hey this is really cute. Can I have one?”

And I thought, “Gosh, this would be so fun.” I’ve always had an entrepreneurial spirit. I was selling stuff on the playground.

Anyway, started sewing the purses, filled a couple orders, and then I was like, “Nick, if I could get this up and rolling then I could stay home and raise a bunch of your kids!” Thankfully, he has never said no to business adventures. He was very, very encouraging.

I eventually quit radio. I stayed up that night until 2:00 a.m. sewing. I was so excited. Then, I woke up at 4:00 a.m. and continued. I could not wait to hit the ground running with my own thing.

Adam: You were on fire!

Rebekah: I was so on fire. At one point, I ran out of money for supplies, and I was pacing around in my living room like, “What am I going to do? I can’t take anything to the show.”

My curtains were super cute. So, I crawled up on a stool and cut my curtains down and put those into purses. I love that story because that’s like, if you want it, there are options. There are tons of options.

Adam: Did you set out to own your own business?

Rebekah: Yeah, I wanted it to be mine. I love sewing and I love creating. It’s still my biggest mission; I just want to sew purses. We have lots of things that we sew, but I want to sew purses and raise kiddos.

I’ve been pitched different places in town to set up and I was like, “No.” Because then I can’t be home with the kiddos. I’ve just been very clear about what I want to do, and I still want to manufacture. And we’ve been pitched different manufacturing facilities and I’m like, “No.” I want to sew, and I want to provide jobs.

If you want to know more about Rebekah and Nick Scott’s businesses or finances, you can watch the full podcast episode, “How We Money: When Farming Meets Fashion,” on YouTube or listen on your favorite podcast app.

And if you find yourself inspired by their story, reach out to our team at First National Wealth Management; we’d love to start a conversation.

Any comments, insights, or strategies discussed in this article are intended to be general in nature and, therefore, may not be suitable for you and your situation, whatever that may be. Before acting on anything written here, please consult with your attorney, CPA, and/or your financial advisor.